Annnnnddd POP!!! Everyone saw this coming of course, right? So the floor of the descending triangle finally broke, now what?

BTC on the Daily TF with Descending Triangle, a pattern every person in crypto has been looking at for the best past of 2018, I wrote about it here; link

Press enter or click to view image in full size

BTC Daily with Descending Triangle — https://www.tradingview.com/x/IkZ6jjXG/

We broke to the downside, not really that surprising considering the bearish nature of the pattern.

However a kick in the guts still hurts even when you are somewhat prepared for it.

So what now then?

Instinctively we zoom out of course, we start looking for the narrative to reassure ourselves that this is just temporary, it can’t really go to zero can it? (Bad habits die hard)

Press enter or click to view image in full size

Well I can’t tell you it won’t. Anyone that tells you they know for sure where the price of BTC is going is either lying or deluded. So I’ll refrain form saying anything in that regard, above is the monthly view of BTC with a rough upward trend line that has been touched a few times but finally broke towards the end of 2018, is this important? I’m not sure tbh, there’s not much we can do about it now anyway so we move on.

A few Questions

Do i really think we will revisit a previous ATH as I indicate in the above chart? Its definitely something I’ve planned for.

Should I be looking for a short entry here? Maybe but the opportunity to short with more comfort was throughout 2018. That’s easy to say now I know but being over 80% away from the previous high does not seem like an optimal time to start thinking about shorting, not without a decisive move.

Is this a great time to buy BTC at a discount rate? Possibly, a test of the previous support where broke through the descending triangle pattern has yet to occur, we could be forgiven for thinking this is inevitable but again its a possibility rather than probable.

Opportunities a plenty!

There will likely be many opportunities to go long or short but getting trigger happy on $50 moves is not something you should entertain, we are ranging, accept it. We could consolidate for some time but then again we might not.

Press enter or click to view image in full size

I recently started getting into patterns, or should I say fractals (complex patterns that are self similar across different scales)

I noticed the above similarities that BTC was showing to the path Silver had already taken. Which got me thinking…. What if this consolidation and relatively narrow ranging continues… all year!?!

I am, I suppose, a trend follower. Having devised a strategy and system that performs best in these conditions.

If what we have seen for the best part of 2 months now is going to continue I might need to look outside of crypto to apply my trading system to better effect or develop one that allows me to take advantage of these ranges. This is definitely something you could look at yourself whilst we wait for BTC to make up it’s mind where it wants to go.

Something that we can’t lose sight of and therefore have to consider is, that we will not be heading straight back up to our ATH (sorry to break the news) and we might not take a one way ticket through purgatory either.

What can we do if this is the case? Plan for all eventualities.

Unbiased

I like it on the fence, don’t judge, its my money that’s at stake also — I would commit to saying that from my perspective it doesn’t actually matter which way price starts to lean and I’ll explain why;

Look for the positives

Zooming out, seeking solace with the rest of the crypto community or getting stuck back into the charts to try and work out how to predict the future is one way to deal with the disappointment.

Another way is to take something from the experience.

You potentially popped your cherry, just like many others (me included) my first real bubble experience, what a ride!

That’s a good thing despite how it tastes currently, you should (if you learn from it) be able to recognize it again but more importantly you should understand your emotions better having been through the experience and realise how they can be so misleading when it comes to trading.

That’s why so many traders attempt to remove themselves from their trading where possible, whether that’s through automation, trading signals, defined rules or whatever they will all try to adhere to strict logic which is predetermined; A strategy, this would be a good time for you to understand yours if you don’t already have one.

The Bubble Burst! Are you ready for the next one?

The benefits of having a trading plan

Stop being so non-committal

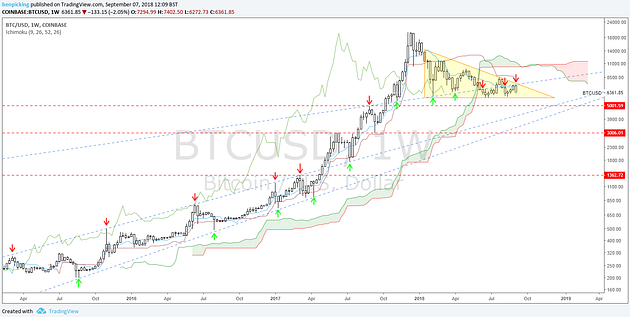

So this is what I am looking at, I haven’t learnt much Price Action and I’m too busy from scalping and even day trading tbh so my natural habitat is the weekly TF anyway.

The price of BTC still drives the market, although a good leading indicator lately has been LTC, I used to like BCH for this but post fork I rarely venture to that ticker now. The only tech that seems close to breaking free is XRP but let’s face it, it’s a little bit different anyway.

Otherwise BTC is still reigning supreme and continues to influence the entire space.

So we will concentrate our efforts here;

Press enter or click to view image in full size

The Final Flush — Might be something we want to consider based on history.

As I said earlier, we zoom out after such a big move automatically, the above is what everyone is seeing now, I have some levels set and am happy to observe from this point.

Press enter or click to view image in full size

BTC Weekly with considerable Gaps

This is where I was back in Sept-18, Link, I wrote that I felt there was quite a lot of missing data (gaps) that I was not used to seeing (mainly because I trade more established markets). This is due in part to the meteoric rise we saw throughout 2017 but also the assets maturity.

Those gaps might not get filled but if I was a betting man (I’m a trader so I must be) I would say nothing is impossible.

There is also a healthy viewpoint that could see us retest the support that was in place for the most of 2018 the $5800-$6000 area (the bottom of that descending triangle) but again we won’t go straight there either.

Could you long from here to there? It’s an option but you would want to see some more volume for starters, this doesn’t necessarily come with a price increase so could be lagging or leading. Look for some recent levels to be breached and go from there.

Rules of thumb that are often forgotten;

- We don’t long resistance

- We don’t short support

Find your levels and state your business. Here’s some that I will be taking note of;

On the upside; $6000 is now a rather large hurdle but still in range albeit $3500 is proving difficult enough, past here and $4000 looks a decent area to reassess.

To the downside; $3000/$2500k/$1800 and $1300 but dont rule out $750 (ouch that one would hurt)

Understanding that we are still in a bear market, any strength that is shown should be considered an opportunity to short, but… as I said previously being this far from the ATH already, the appropriateness of that call is difficult to justify so be careful and risk averse where possible.

Depending on your personal preference or trading style, scalping, day, swing or position will determine how you make your moves. A contrarian could view this as a good long term buying opportunity and might start looking at averaging down into a position here.

Shorter term strategist will be looking much closer at the detail and the price action, each have their merits depending on your personality type and what suits but both come with associated risk.

Personally I have used the last 12 months for self reflection and refinement of my trading plan, something that I thought was pretty healthy until I decided to write about it and soon found out I wasn’t as prepared, educated or committed to as I thought.

I don’t see any reason to expect anything different from what the market has been displaying over the festive period and into 2019. This being the case I will further automate my trading freeing up time for family and friends or reading that stack of books I have stashed away. Never stop learning and being open to new ideas but also try to absorb the old….. things repeat and old solutions work still.

Don’t read the same books as everyone else and think you will find your edge, use the knowledge to shape your own ideas/opinions and go test them out.

The downside risk is ever present but can be mitigated using many tools these days, you don’t have to sell completely out of the market, although you could.

A 1X short is the same as cashing out and the fees involved might even be favourable.

Despite the reservations and indecisive nature of the market we should remember that even Bears get euphoric and nothing lasts forever even though it sometimes feels like it does, >80% down who would have thought that in Dec-17.

The King is dead…. Long live the King

Just some opinions of a crypto newbie, take them for what they are, unfocused non-committal ramblings.